How your donation can help:

A donation of money helps families in need and situational hardship with:

- meals

- clothing

- mentoring

- counseling

- education and advocacy

- And so much more…

You can take part in impacting the lives of your neighbors in need.

Explore the ways that you can support what you’re passionate about.

Donate in Person

Stop by the Love, Inc. office anytime during hours of operation to drop off a cash or check donation in person.

Watch for contribution opportunities in our thrift stores, such as rounding up, special fund drives, or donation jars.

There’s nothing we are more excited about than getting a chance to meet you and show you why your donations matter here.

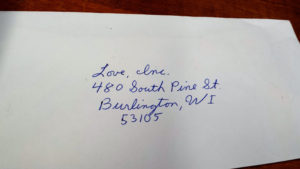

Donate by Mail

Anytime during hours of operation, you can stop by the Love, Inc. offices to drop off a cash or check donation in person.

Watch for contribution opportunities in our thrift stores, such as rounding up, special fund drives, or donation jars.

There’s nothing we are more excited about than getting a chance to meet you and show you why your donations matter here.

Planned Giving

You can help ensure that Love, Inc. will always be here to help those in need by including us in your estate and financial plans. Make a legacy with a living gift and make a lasting impact on our community.

Since estate planning is the process of managing your accumulated assets for the present and future, a planned gift is included in a written statement of your overall intentions for your resources.

Planned gifts can offer many advantages to help you meet your overall financial goals and leave a legacy to sustain the independence of Love, Inc., while at the same time providing yourself and your family (or other beneficiaries) with significant tax benefits. A planned gift can also provide special opportunities that enable our organization to strengthen and improve its programs.

The best gift is one that is appropriate for you. In addition to outright, tax-deductible cash gifts, there are other creative ways to give, including:

- Gifts of stock or other assets

- A bequest in your will

- A beneficiary designation on a life

- Life Income Gifts Insurance Policy, 401(k) Plan, or IRA

- Charitable Lead Trusts

Please be advised that the information provided on this website is not intended as tax or legal advice, but as accurate and authoritative general information on planned giving. For legal advice, please consult with your attorney and /or tax advisor.